J&J Buys Halda: Another Win for Big Pharma, Another Loss for Patients?

Okay, so Johnson & Johnson is buying Halda Therapeutics for a cool $3.05 billion. Big deal. We've seen this song and dance before. Biotech gets hot, Big Pharma swoops in, everyone pats themselves on the back, and the potential life-saving drugs get... what? Shelved? Priced out of reach? Let's be real, it's usually one of those two.

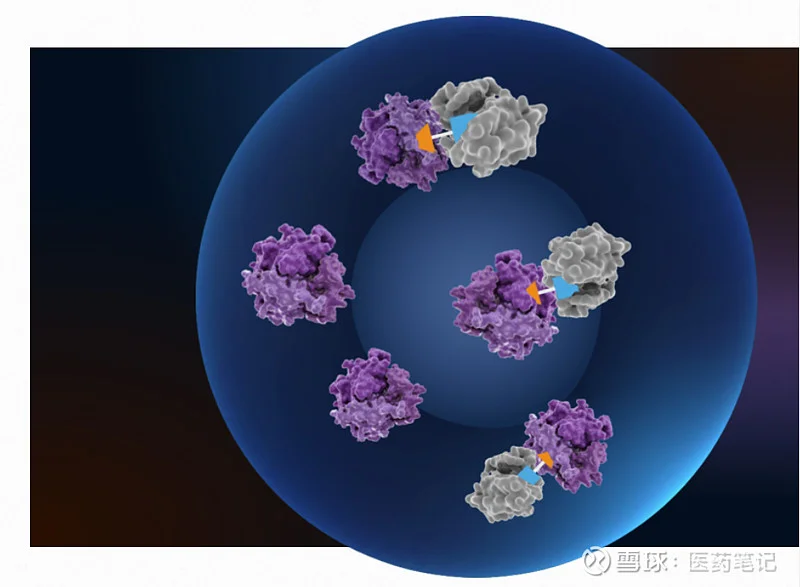

Halda's got this RIPTAC™ platform – Regulated Induced Proximity Targeting Chimeras. Sounds impressive, right? It's supposed to "hold and kill" cancer cells. Their lead drug, HLD-0915, is for prostate cancer, which J&J is touting as a potential game-changer, claiming it can overcome resistance to existing treatments. Halda Therapeutics Announces Acquisition by Johnson & Johnson

Jennifer Taubert, executive vice president at J&J, says this acquisition "further strengthens our deep oncology pipeline." Translation: "We just bought ourselves another potential blockbuster and we're gonna squeeze every penny out of it." I mean, come on, give me a break with the corporate speak.

The Usual Suspects

And then there's John C. Reed, M.D., Ph.D., also from J&J, gushing about the "impressive preliminary efficacy" and "strong early safety profile" of HLD-0915. Ofcourse, he is. That's what they always say. It's the same script every single time. Show some promising early data, hype it to the moon, and then… well, then reality sets in.

Look, I'm not saying this Halda drug is snake oil. Maybe it will be a miracle cure. But history tells us that when these smaller companies get swallowed up, innovation often takes a backseat to profit margins. Will J&J really prioritize getting this drug to the people who need it most, or will they be more concerned with pleasing shareholders?

They're saying it could reach 1.7 million new diagnoses of prostate cancer globally by 2030. That's a lot of potential customers... I mean, patients.

The Fine Print (and the Missed Deadlines)

The deal's supposed to close "within the next few months," subject to the usual antitrust clearance and whatnot. Which, let's be honest, probably means it's a done deal. Big Pharma always gets what it wants. J&J is even projecting a $0.15 dilution to Adjusted Earnings Per Share in 2026 due to this. They've already factored in the cost of buying up Halda employees' equity. It's all just numbers on a spreadsheet to them.

Here's what really grinds my gears: these acquisitions are never about altruism. They're about market share, eliminating competition, and controlling the narrative. We're supposed to believe that J&J is doing this out of the goodness of their hearts, to bring life-saving treatments to the masses. But let's not forget that these are the same companies that have been accused of fueling the opioid crisis and jacking up drug prices to obscene levels.

I saw another article saying that Halda was founded in 2019 and has been funded by a bunch of venture capital firms. So, basically, this is a win for the investors who saw a potential payday, and maybe, maybe, a win for some prostate cancer patients down the line. But for the rest of us? It's just another reminder that the healthcare system is rigged in favor of the wealthy.

Then again, maybe I'm just being cynical. Maybe J&J will actually do the right thing this time. But I ain't holding my breath.

Another Brick in the Wall...

So, what's the real story? It's the same old story. Consolidation, control, and a whole lot of money changing hands. Don't expect miracles.