Betting on Tomorrow: The Enduring Power of the Foundation vs. The Rocket Fuel of Innovation

Alright, let's cut through the noise, shall we? You've got these two titans of the investment world, VOO and QQQ, constantly duking it out for your attention, and frankly, the numbers can be a bit of a blur. But what we’re really talking about here isn't just tickers and percentages; it's about how we, as forward-thinking individuals, choose to participate in the grand, exhilarating experiment of human progress. It's a choice between the deep, stable currents of the American economy and the high-voltage surge of technological disruption. And trust me, both have their own kind of magic.

Imagine, if you will, standing at the edge of a bustling, futuristic city. On one side, you have the robust, sprawling infrastructure – the power grids, the transportation networks, the essential services that keep everything running smoothly. This, my friends, is your Vanguard S&P 500 ETF, or VOO. It’s the broad strokes, the foundational strength of 505 companies that make up the S&P 500, a veritable cross-section of American ingenuity. Its 15.2-year track record isn't just a number; it's a testament to its enduring resilience, a bedrock of stability. When you buy VOO stock, you’re not just buying a piece of a company; you're buying a sliver of the entire American enterprise, from the steady hum of financial services to the essential rhythm of healthcare and the ever-evolving consumer cyclicals. It’s the kind of investment that lets you sleep at night, knowing you’re deeply embedded in the economic fabric that supports all the innovation. The Motley Fool itself holds VOO, and it's easy to see why it’s considered a core position for long-term growth.

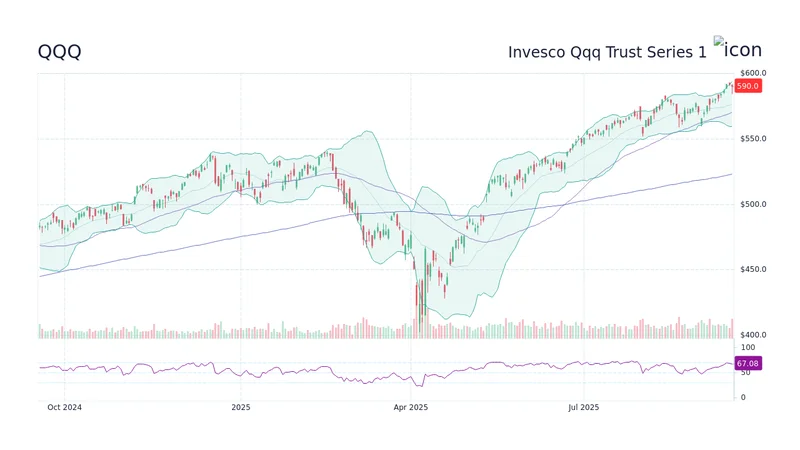

But then, over on the other side of our futuristic city, you see the gleaming towers of innovation, the research labs buzzing with activity, the data centers humming with untold possibilities. This, my friends, is the Invesco QQQ Trust, Series 1. This isn't just a part of the city; it's the engine room, the concentrated power of the NASDAQ-100, a collection of 101 companies primarily focused on technology and growth. Think NVIDIA (NVDA stock), Microsoft (MSFT stock), Apple, Amazon (AMZN stock), and Google (Alphabet) – these aren't just companies; they're architects of the future, constantly pushing the boundaries of what’s possible. QQQ’s portfolio is like a finely tuned supercharger, heavily weighted towards technology (a staggering 54%) and communication services. It’s designed for speed, for that exhilarating rush of being at the forefront.

The Dance of Risk and Reward: Where Does Your Vision Lie?

Now, let's talk numbers, because while I love the grand vision, the data tells a compelling story of its own. As of November 14, 2025, QQQ delivered a phenomenal 1-year return of 19.7%, practically leaving VOO's respectable 13.3% in its dust. Over five years, a $1,000 initial investment in QQQ would have blossomed into $2,077, outperforming VOO's $1,855. That's the power of concentrated growth, the sheer velocity of these tech giants. When I first saw the trajectory of some of these companies, I honestly just sat back in my chair, speechless. It's not just growth; it's a fundamental reshaping of our world, a digital renaissance happening before our very eyes!

But here’s the rub, the exhilarating part of the ride: with that kind of explosive potential comes a different kind of journey. QQQ’s Beta, a measure of its volatility relative to the broader market, clocks in at 1.10. In simpler terms, when the market zigs, QQQ zags a little harder, both up and down. This translates to a deeper maximum drawdown over five years—35.12% for QQQ compared to VOO's 24.52%. It’s like comparing a leisurely cruise to a SpaceX launch: one’s smooth sailing, the other’s pushing the boundaries of what’s possible, and sometimes, you hit turbulence, but the view from orbit? Unmatched. QQQ stock price might swing more, but for many, the potential upside is worth the ride.

VOO, with its lower expense ratio of 0.03% (compared to QQQ's 0.20%) and its massive $1.4 trillion in Assets Under Management (AUM) – dwarfing QQQ's $397.6 billion – offers a different kind of strength. It’s the steady hand, the diversified approach that includes financials, healthcare, and industrials, sectors that often provide ballast when the tech winds blow a little too fiercely. It’s the anchor that holds firm, offering consistent, broad market exposure.

So, here’s the profound question that we all face: Are you looking to own a piece of the entire symphony, the harmonious blend of all sectors that make up the U.S. economy, or do you want to bet big on the virtuoso soloists who are redefining the genre, companies like NVIDIA, or even the potential future titans like Tesla (TSLA stock) or Palantir (PLTR stock) that QQQ's philosophy often champions? What kind of future are you trying to build with your capital, and what level of exhilarating uncertainty are you willing to embrace to get there?

The Future Isn't a Spectator Sport

This isn't just about picking between two ETFs; it's about aligning your investment strategy with your vision for the future. VOO offers that robust, diversified backbone, the essential foundation upon which all innovation rests. QQQ offers the concentrated, high-octane engine of technological disruption, the companies that are actively building that future, often at warp speed. Both are powerful tools, representing different facets of human endeavor and economic growth. The true genius, I believe, lies in understanding how these incredible instruments can work together, or stand alone, to craft a portfolio that reflects not just where the market is, but where you believe it's going. Because in this rapidly evolving world, the future isn't waiting for us; it's being built right now, and we have the incredible opportunity to be a part of it.