Zillow's $16,000 Homeownership "Hidden Cost" Bombshell: Why It's Actually a Wake-Up Call for a Brighter Future

The Real Cost of the American Dream?

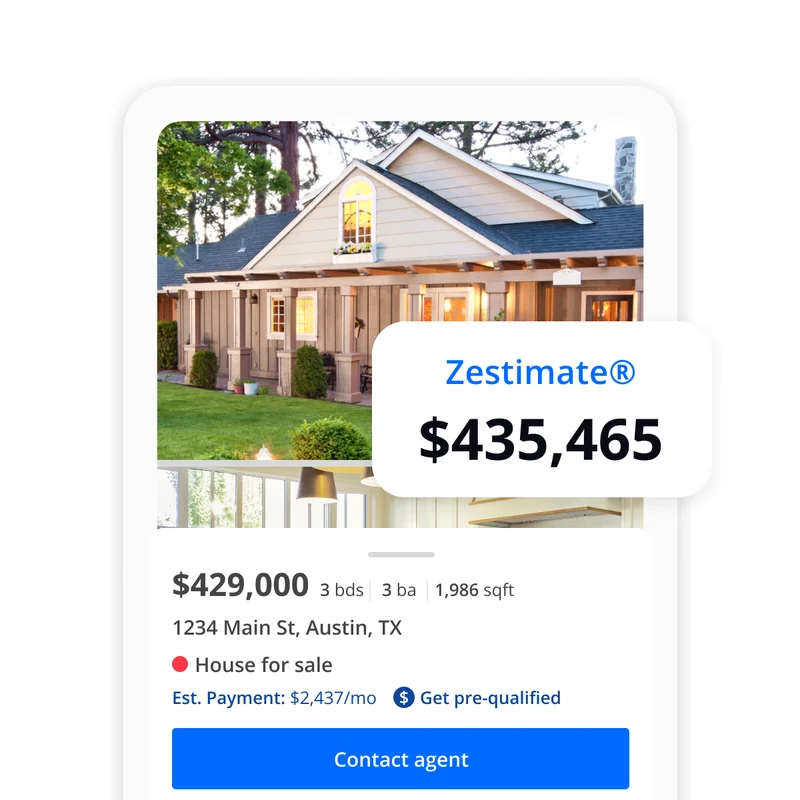

Okay, folks, let's talk about Zillow's latest headline: nearly $16,000 a year in "hidden costs" for homeowners. Property taxes, insurance, maintenance… it adds up, right? The initial reaction might be a collective groan, another nail in the coffin of affordability, especially for first-time buyers already wrestling with high prices and interest rates. I saw one headline calling it a "bombshell." But honestly? I think it's a wake-up call, a chance to rethink how we approach homeownership and build a more resilient future.

Zillow's numbers paint a stark picture: $10,946 on maintenance, $3,030 on property taxes, and $2,003 on insurance, annually. And it's not evenly distributed. Coastal metros like New York City and San Francisco are getting hammered, with hidden costs exceeding $24,000 and $22,000, respectively. We're talking about real money, the kind that can make or break a budget.

But here's where I think we can flip the script. Instead of seeing this as a burden, let's view it as an opportunity to innovate, to design more efficient and sustainable homes, and to build stronger communities. Think about it: preventative maintenance, as Thumbtack's home expert Morgan Olsen points out, is a "safety net" for your biggest asset. What if we could leverage technology to make that safety net even stronger, even more affordable? What if we could create homes that practically maintain themselves?

Kara Ng, Zillow's senior economist, said insurance costs are rising nearly twice as fast as homeowner incomes. It's a barrier to entry, she says. I agree, but what if we could use technology to predict potential issues before they arise? Imagine sensors embedded in walls detecting leaks before they cause mold, or smart roofs that automatically clear snow to prevent structural damage. We're talking about moving from reactive maintenance to proactive prevention. It's like the difference between treating a disease and preventing it in the first place.

Consider Florida, grappling with a home-insurance crisis and extreme weather events. Premiums in Miami have jumped 72% since 2020! That's insane. But it's also a catalyst for innovation. What if we could build homes that are inherently more resilient to hurricanes and floods? Think about stronger building materials, elevated foundations, and smart drainage systems. This isn't just about saving money; it's about protecting lives and livelihoods. I truly believe that if we can make a real change here, the potential for long term change is huge.

I remember reading about Arcosanti, Paolo Soleri's experimental town in Arizona. It was an attempt to create a self-sufficient, sustainable community, a place where architecture and ecology were seamlessly integrated. It was an ambitious, flawed project, sure. But it sparked a conversation about how we can build more thoughtfully, more responsibly. What if Zillow's numbers are the spark for our generation's Arcosanti, a catalyst for rethinking the very foundations of homeownership?

The cost of insurance is high, yes. But what if communities invested in renewable energy and smart grids? What if we fostered local economies that rely less on long-distance supply chains? These are big questions, I know, but they're worth asking. As Zillow recommends, prospective homeowners need to understand their "true buying power." But that buying power isn't just about dollars and cents; it's about our collective ability to shape the future of housing. You can read more about Zillow's findings in Hidden costs of homeownership reach $16K per year.

The Future is Built, Not Bought

It's easy to get bogged down in the numbers, to see Zillow's report as just another sign of economic doom and gloom. But I choose to see it differently. I see it as a call to action, an opportunity to build a more sustainable, more resilient, and more affordable future for everyone. Let's get to work.