Generated Title: IRS Gives You an Extra Grand for Retirement? Don't Fall for It.

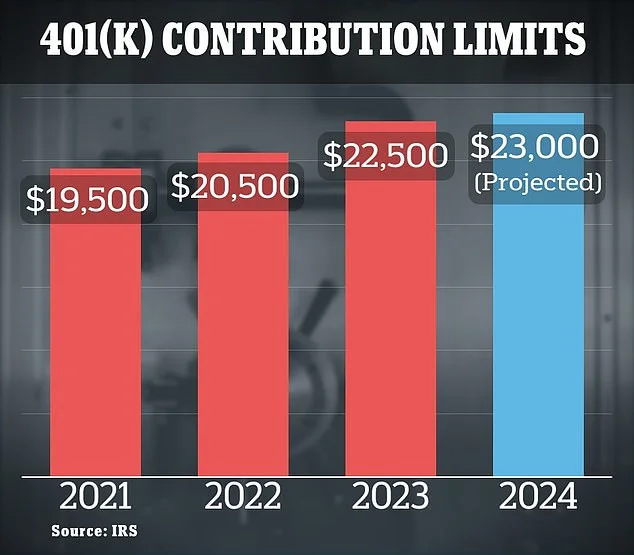

Alright, so the IRS "generously" decided to bump up the 401(k) contribution limit by a whole grand for 2026. And the IRA limit? A measly $500. Big whoop. Let's be real, are they actually doing us a favor, or is this just another way to keep us chained to the grindstone until we're six feet under? IRS announces 2026 401(k) contribution limits, raises savings cap.

The Illusion of Choice

They dangle these "increased limits" in front of us like carrots on a stick. "Oh, look, you can save more for retirement!" Yeah, if you have it to save in the first place. Most Americans are struggling to make rent, let alone max out their 401(k)s. It's like saying, "Hey, you can buy a yacht! Just gotta find a spare million or two lying around."

And let's not forget the fine print. These limits are just for pre-tax contributions. So, you get to defer paying taxes now, but Uncle Sam will be waiting with his hand out when you finally try to enjoy that "retirement" you've been slaving away for. It's a long con, plain and simple.

The catch-up contributions for those 50 and older? Please. By the time you're 50, you're probably already behind the eight ball, desperately trying to make up for lost time. And the "super catch-up" for those aged 60 through 63? That's just insulting. You're practically at the finish line, and they're throwing you a bone that barely covers the cost of a decent nursing home.

Inflation: The Real Winner

The IRS tries to paint this as some kind of benevolent act, adjusting for inflation to help us keep up. But let's not forget why these adjustments are necessary in the first place: because inflation is eating away at our savings! They're basically giving us back a fraction of what they're taking away. It's like a pickpocket returning your wallet with a five-dollar bill still inside.

They use the CPI as the basis for their calculations, which, offcourse, everyone knows is a joke. The CPI conveniently underreports the real cost of living, so these "adjustments" are never enough to truly compensate for the rising prices of everything from gas to groceries.

And don't even get me started on the income eligibility ranges for IRAs and the Saver's Credit. They're so complicated and convoluted that you need a PhD in tax law to figure out if you even qualify. It's designed to be confusing, so most people just give up and let the rich get richer.

Secure 2.0? More Like Secure 0.2

They keep touting the SECURE 2.0 Act as some kind of game-changer, but let's be real: it's just window dressing. A few minor tweaks and adjustments that barely scratch the surface of the real problem. The "super catch-up" provision? A joke. The annual cost-of-living adjustment for IRA catch-up contributions? A pittance.

They're throwing crumbs at us and expecting us to be grateful. It's like a landlord raising your rent by $500 and then offering you a free coffee as compensation. Give me a break.

But wait, am I the crazy one here? Maybe I'm just being too cynical. Maybe these small increases actually do help some people. Maybe... nah, who am I kidding? This is all just a big, elaborate charade designed to keep us working until we drop.

So, What's the Real Story?

This ain't about helping you retire. It's about keeping the machine running. Don't fall for the hype.